El Romero - Image: Acciona

As a result of an overwhelming amount of growth in the industry, Solar PV is moving beyond the Power Purchase Agreement (PPA) contract structure into the merchant solar market. Unlike the current PPA format, where a solar developer signs an agreement with a customer to purchase power from the solar plant at an agreed-upon price for several years (often fifteen or more), selling electricity on the wholesale power offers the possibility for market prices to fluctuate on an hourly basis. Solar PV project development has been historically driven by utilities focused on issuing PPAs as a way to meet mandated national renewable requirements. However, massive declines in solar development costs and technological advancements have had a significant effect on solar PV economics and PPA pricing. Since 2006, Solar PPA prices have decreased every year, amounting to a decrease of more than two-thirds since 2009.

Luz del Norte - Image: First Solar

In addition, solar costs have also been on a constant decline, resulting in the growth of the solar merchant market, especially in regions with high solar irradiation. Global utility PV system prices have been decreasing sharply, with India being able to achieve the lowest system prices of any major solar market in the world at $0.65 per watt. The continually declining costs per watt of capacity for silicon solar panels around the world have been one of the main drivers for system price reductions, as panels have dropped from $10 per unit in 1987, to $0.22 in 2017. Nonetheless, experts believe that the reductions will not only come from module pricing, but will now also be further pushed down by price reductions in inverters, trackers, and even labor costs. In Europe, the U.K. has the lowest-priced solar at around $1,00 per watt, mainly due to its common adoption of string inverters, leading to lower costs. In Latin America, Mexico and Chile are the two key players when it comes to low-priced utility PV systems, respectively achieving a price of $0.84 and $1.15.

In order to show the market potential of merchant solar around the globe, Solarplaza has compiled an overview of the top 15 solar merchant plants that are currently active and selling power on the spot market. This list of merchant solar plants comes in preparation of our one-day conference, Solar Market Parity, set to be held in Milan on the 5th of June, 2018. The following section will look at the top 15 merchant solar plants operating around the world .

Top 15 Merchant Solar Plants

| # | Name | Size (MWp) | Owner | Developer | Amount (M$) | Year | Country | Location |

|---|---|---|---|---|---|---|---|---|

| 1 | El Romero | <250 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 2 | Luz del Norte | <150 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 3 | Santiago Solar Project | <120 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 4 | Bolero West | <90 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 5 | Carrera Pinto Phase 2 | <80 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 6 | Crucero (formerly "Maria Elena") | <80 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 7 | Salvador | <70 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 8 | Bolero East | <70 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 9 | San Pedro III | <60 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 10 | San Andres | <60 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 11 | Aura I | <40 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 12 | La Huayca | <30 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 13 | Barilla | <20 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 14 | Jalisco I | <10 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

| 15 | Jalisco II | <10 | F.O. | F.O. | F.O. | F.O. | F.O. | F.O. |

F.O. = Full overview: Check out the full overview to get detailed information on:

-

Exact plant size

-

Owners

-

Developers

-

Plant value

-

Commission date

-

Location

Top Projects

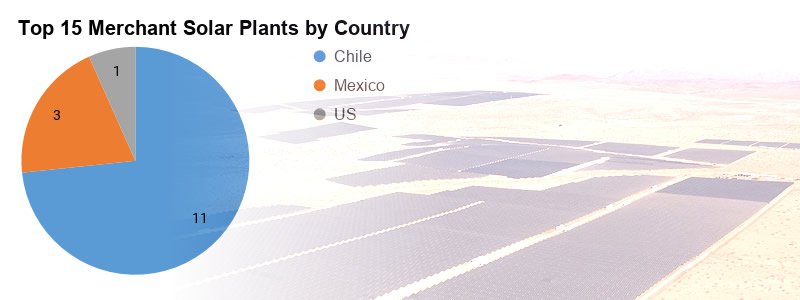

Chile was found to be the country with the largest amount of entries in the top 15 Merchant solar plants, with 11 active projects, followed by Mexico with 3 plants in operation and trailed by the US with one operational project that was able to make our list. Chile also is home of the top 3 ranked merchant solar PV plants.

The largest plant ranked on our list is the El Romero solar project located in the Vallenar, Atacama region in Chile, with a whopping capacity of 246 MW. El Romero is a part-merchant solar project and is being operated by Acciona Energy since its commissioning in 2016. It is also one of the largest active solar PV plants in Latin America. The second largest plant on our list, the 141 MW Luz del Norte, is the largest fully-merchant solar plant in the world and is also located in Chile. The plant was developed and is owned by First Solar, which also owns the 18 MW Barilla merchant solar plant located in Texas, USA. The third largest plant is the 115 MW Santiago solar project owned by EDF Energies Nouvelles and the Andes Mining Energy located in the Santiago Metropolitan region in Chile and was commissioned recently in January 2018.

Chile has enjoyed massive growth in the solar energy market, reaching more than 2 GW of cumulative installed capacity by the end of 2017. Due to the lack of domestic fossil fuels and the electricity-intensive mining industry, Chile was able put the spotlight on solar and one of its most valuable resources in that regard; the sun-drenched Atacama Desert. Most of the Chilean merchant solar plants ranked on our list are located in the Atacama Desert, starting from the Tarapaca region in the north of the desert, all the way to the Antofagasta region located in the southernmost area of the desert.

Top Players

Looking at the top players on our list, there are a few things that stand out. Firstly, there is no clear market leader. Most asset owners only own one merchant solar plant on our list, except for American giants First Solar and SunEdison that own two plants each, amounting to a total of resp. 159 MW and 123.5 MW. Other remarkable players include French powerhouse EDF Energies Nouvelles, which jointly owns two projects, one with Marubeni and one with Andes Mining Energy, amounting to a total combined capacity of 257 MW split between the three solar plants, Santiago Solar Project, Bolero West and Bolero East. This showed that the merchant solar market is still fragmented and is still maturing as it attracts more attention from developers and investors. The high risk nature of merchant solar is also a factor that has been strongly affecting the growth of the wholesale energy market.

Future Developments in Europe

There are clear challenges and barriers affecting different merchant markets around the world. Europe, for example, has shown limited materializations of merchant solar, but has a huge pipeline of projects pending to be commissioned in the coming years.

For example, Spain has more than 1 GW of merchant solar plants in the pipeline, primarily consisting of large-scale projects, such as the 500 MW Solar Núñez de Balboa plant, which is being developed by Grupo Eco and will be located in the Extremadura region. The country is also expecting more activity in the southern region, like Elloymay’s plans to build a 300 MW solar plant in the Murcia Region to start selling electricity on the spot market by 2020, or Eco Energy World’s target to develop and construct 600 MW of solar projects over the next three years.

Other countries in the south of Europe have also announced large-scale merchant solar projects, such as Italy and Portugal. Italy has experienced a growth of around 409 MW of new PV installations in 2017, showing a growth of 11% since 2016. Of that newly installed capacity, 66 MW consisted of several “grid-parity” ground-mounted PV plants being connected to the grid. For 2018, Italy looks to grow even more with different merchant projects in the pipeline, such as Octopus Energy’s initiative to develop 110 MW worth of merchant plants across the country. In Portugal, WElink and CTIEC have teamed up to develop a 221 MW plant that will be located in the region of Algarve and will start feeding energy to the grid by mid-2018.

Santiago Solar Project - Image: EDF

Some experts believe that these merchant projects have to be careful to not make the same mistake that happened in Chile, as they run the risk of “cannibalizing” themselves by producing large volumes of solar energy, leading to a reduction of the high wholesale power prices that projects strongly rely on and that are essential to the success of solar PV projects.

The coming year is expected to bring great development for merchant solar markets across the world. One of the fastest growest solar markets in the world, Australia, is expecting the 128 MW Sun Brilliance project to be commissioned, which will be the country’s largest merchant solar PV plant to date. The US also has major plans, one of them being a 100 MW fully-merchant plant currently under development by BlueChip Energy.

Energy market competition is projected to intensify in the coming years, which could allow for a growth in the access of funds from foreign investors in the form of private equity. Breakeven prices for utility-scale solar have been reached in more than 20 countries, where the price is at - or below - current spot prices for electricity. It will be interesting to see how the merchant solar market is going to develop in the near future. However, one thing is certain: prices for solar energy installations are expected to keep on dropping, leading to more countries reaching grid parity. Places with high solar irradiation, such as Southern Europe and Australia, will be the key markets to keep an eye out as these regions are already are becoming pioneers when it comes to the development of merchant solar projects.