#1 Villanueva

The Latin American and Caribbean region is among one of the prime places in the world where the conditions, abundance of natural resources and enabling political climate have fostered a fruitful environment for the development of renewable energy sources. All of these factors have resulted in a booming solar industry that is set to exceed even the expectations of all players involved.

As a build up to our Unlocking Solar Capital LAC (Latin America and the Caribbean) conference, Solarplaza has compiled a list of the Top 30 operating solar PV plants in the Latin American and Caribbean region. This overview serves as complementary material to the Unlocking Solar Capital LAC (28-29 June, Miami) conference Solarplaza will be organizing focused on Latin America and the Caribbean. This article provides an updated overview of the main solar PV plants active in some of the key markets in the region. Unlocking Solar Capital LAC - an industry-unique conference focused on the ways to unlock capital for solar development in Latin America and the Caribbean. This event will serve as a hub to connect investors with developers and provide an ideal opportunity to form long-lasting business relationships with industry professionals.

Top 10 (Operational) Latin American Solar PV Plants

| # | Plant Name | Size (MW) | Country | Location | Since | Owner | Developer | Value ($m) | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Villanueva | 310 | Mexico | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 2 | Nova Olinda | 292 | Brazil | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 3 | Pirapora Solar Project | 284 | Brazil | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 4 | Ituverava | 254 | Brazil | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 5 | El Romero | 246 | Chile | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 6 | Don José | 238 | Mexico | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 7 | Rubi Solar PV Plant | 180 | Peru | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 8 | Finis Terrea PV project | 160 | Chile | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 9 | Solar Park Lapa | 158 | Brazil | F.O. | F.O. | F.O. | F.O. | F.O. | |

| 10 | Bolero Solar Project | 146 | Chile | F.O. | F.O. | F.O. | F.O. | F.O. | |

Access the full Top 30 overview, for the complete Top 30 list, include details on:

- Detailed location

- Operational date

- Ownership

- Developers

- Plant value

Quick facts and figures

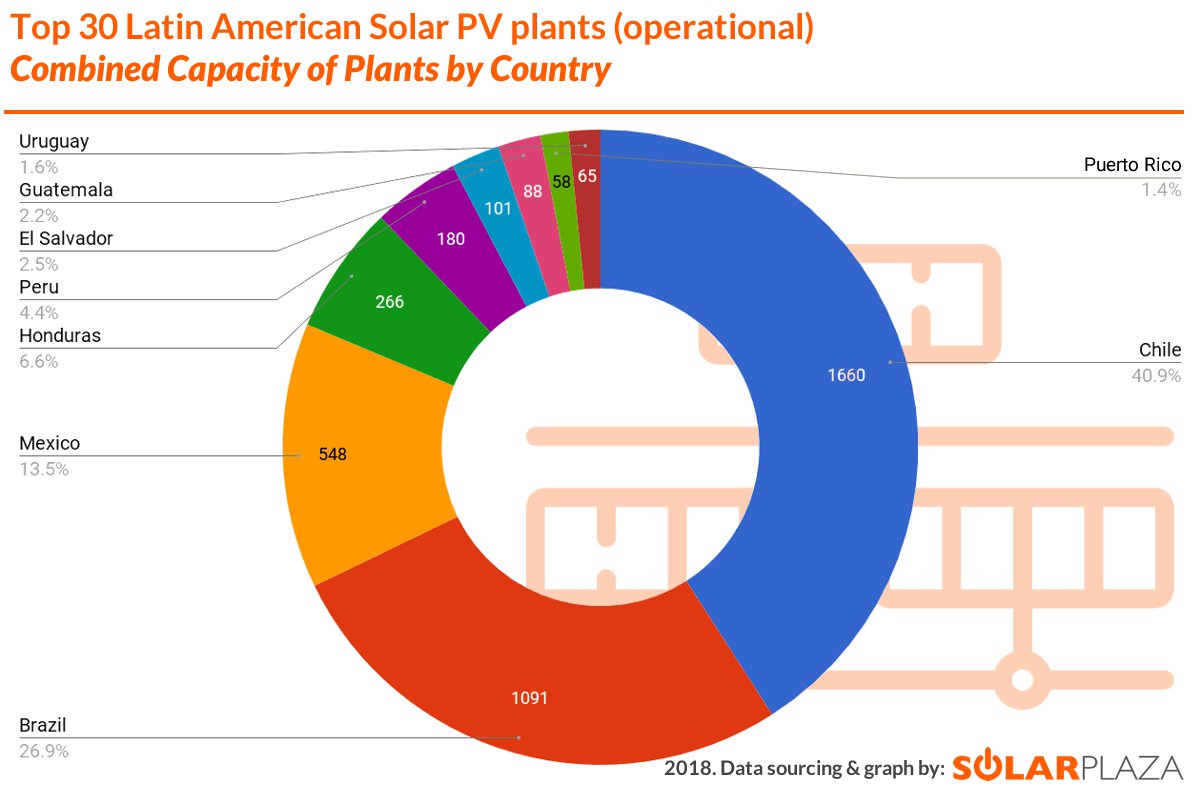

The Top 30 operational plants in Latin America and the Caribbean together accounts for over 4.0 GW of installed capacity in the region. This value has increased significantly since our previous report, where only 2.3 GW worth of operational plants made it to the top 30. Despite the growth of the scope, a few trends have remained similar to previous years, with some significant changes happening with regards to the installed capacity of the top 3 countries.

Looking at the top 30 solar plants, Chile continues to be the most popular country for solar PV developers with 3 times the amount of PV plants as the second most popular destination, Brazil. Additionally, there are some regions that have received more focus than others. The Atacama region remains to be the region with the largest amount of Chilean solar plants in the Top 30, with 6 plants currently in the operational phase, followed by the Antofagasta region, with 5 of the listed PV plants. Together those regions have a combined installed capacity of more than 1.5 GW, making them the most attractive regions in Chile for solar PV development, due to the high levels of solar irradiation.

Brazil was able to climb the ranks of this year’s list as the country with the second largest amount of PV plants, as well as ranking second in terms of installed solar PV capacity (in the Top 30). This was a big jump since it was ranked last in our previous Top 30. The main reason for this jump was the commissioning of 5 substantial solar projects in 2017 and 2018, with a combined capacity of more than 1 GW added to the country’s grid. This is a new record for Brazil since it had only an installed capacity of 80 MW at the end of 2016.

Mexico arrives in third place; a remarkable feat, considering it only has two plants in the Top 30 list. Its biggest plant, the Villanueve solar PV project, boasts an impressive capacity of 310 MW. Additionally Mexico just inaugurated another major solar plant (in May), the 238MW Don José plant. This made it possible for Mexico to trump Honduras in the rankings, which has 3 PV plants on our list, which however “only” amount to 266 MW. Peru and the other countries in the overview each only harbour one of the top 30 largest PV plants.

The ownership in the region is rather international and fragmented, yet there are some key players that stand out. One of the most frequently encountered companies in the list is Enel Green Power (EGP), which owns 10 plants from the list, amounting to more than 1.8 GW. Enel has taken a more broad approach this past year, when compared to previous years, developing 7 PV plants outside of Chile and commissioning the region’s largest PV plant in Mexico.

SunEdison currently has 3 Chilean plants on our list totaling 268 MW, which decreased from the amount of last year. However, it still needs to be seen how the company will develop and manage its assets after it emerged from bankruptcy in November 2017. Another notable player was EDF Energies Nouvelles, which has developed three solar plants on our list, two of which are in the top 10 largest plants in Latin America and the Caribbean. EDF jointly owns around 545 MW of installed capacity on our list together with Canadian Solar, Marubeni and Andes Mining Energy.

Major plants

The largest project to date in Latin America & the Caribbean is the 828 MW Villanueva Solar PV Park located in Viesca, Mexico. The overall 828 MW plant is currently over 41% completed, equivalent to around 310 MW in operation. It consists of two parts, Villanueva 1, which is only producing around 120 MW of the 427 MW installed, and Villanueva 3, producing only 190 MW of the 327 MW installed. The plant is being developed by Enel Green Power Mexico (EGPM) and was partly inaugurated on the 22nd of March 2018. EGPM invested around 650 million USD in the construction of Villanueva and is planning on investing around 64 million USD for the expansion of the solar park in order to add 74 MW to the initial capacity of 754 MW. According to EGPM, the expansions of Villanueva will enter into operation in the second half of 2018.

These expansions reaffirm EGP’s strong focus to its contribution to help Mexico achieve the goal of 35% power generation from renewable by 2024. EGPM currently only owns 20% of the plant since it sold 80% stake of the solar plant to Canadian institutional investor Caisse de Dépot et placement du Québec (CDPQ) and Mexican pension fund CKD Infraestructura México S.A. de C.V. (CKD IM) in October 2017.

#2 Nova Olinda

When it comes to the second, third and fourth largest operational plants in the region, all three projects are located in Brazil. The second largest solar plant is the 292 MW Nova Olinda Solar PV Plant in Piaui, Brazil. It was launched in September 2017 by Enel Green Power Brazil, but only reached its full capacity two months later on the 28th of November. Nonetheless, the solar plant was able to be constructed in just 15 months with an investment of approximately 300 million USD. Nova Olinda will be supported by a 20-year power purchase agreement (PPA) with the Brazilian Chamber of Commercialization of Electric Energy.

#3 Pirapora

Number 3 on our list, the 284 MW Pirapora solar project, currently consists of the 191.5 MW Pirapora 1 and the 92.5 MW Pirapora 3 solar plants located in the Brazilian state of Minas Gerais. The project was awarded a 20-year PPA following the first and second Reserve Energy Auctions and was connected to the grid in November 2017. EDF Energies Nouvelles holds an 80% stake in the Pirapora project, with the remaining 20% held by Canadian Solar. The Pirapora solar project is expected to add another 115 MW after the completion of the Pirapora 2 solar plant in the second half of 2018. Once fully operational, the 399 MW project will cover the annual energy needs of 420,000 Brazilian homes.

#4 Ituverava

Nova Olinda’s PPA also includes the 4th largest plant on our list, the 254 MW Ituverava solar plant, which is also owned and operated by Enel Green Power Brazil. The plant is located in the Brazilian state of Bahia and was connected to the grid in September 2017 together with Nova Olinda. The construction of the plant required an investment of around 400 million USD financed with Enel’s own resources as well as through long-term financing provided by sources outside of the company. Both Nova Olinda and Ituverava will provide enough energy to meet the annual energy consumption needs of more than 568,000 Brazilian households.

Undoubtedly, 2017 stands out as the most successful year ever for Brazilian PV capacity, which is growing at an unprecedented pace. According to IRENA’s 2018 Renewable Energy Statistics, cumulative installed capacity grew from 80 MW in 2016 to 1097 MW in 2017, with a whopping increase of more than 1 GW. Most of this additional capacity came from the previously mentioned solar plants that were all commissioned in 2017. The surge of installed capacity is part of Brazil's goal of obtaining 23% of its energy from non-hydro renewable sources by 2030.

#5 El Romero

The fifth ranked solar plant on our list is the 246 MW El Romero Solar PV Plant located in the Atacama Desert. It is Chile’s largest operating solar plant and is capable of generating enough clean energy to meet the electricity demands of 240,000 Chilean homes. El Romero is a part-merchant solar project and is being operated by Acciona Energy since its commissioning in November 2016. For more information on merchant solar plants, see our Top 15 Merchant Solar projects.

Other plants that have been commissioned in 2018 worth mentioning include: the newly completed 283 MW Don José plant in Mexico; the 180 MW Rubi Solar PV Plant in Peru, which became the country’s largest solar project when it was launched in January by Enel Green Power Peru; the 115 MW Santiago Solar project in Chile commissioned in January by EDF Energie Nouvelles, which will sell power partly to the spot market; and the the 110 MW El Pelicano solar park in Chile, which was commissioned on the 11th of January by SunPower Corp and was acquired by Actis on January 25, 2018.

The Top 30 of largest plants, as well as the changes in its ranking over the course of little more than a year, provide key insights into the development of (large scale) solar PV in the Latin American and Caribbean region. Once again, Chile emerged as the leader and most mature market in the region, with the highest number of utility scale solar plants, most of them in the Atacama and Antofagasta region. Although the composition of plants smaller than 100 MW might not have changed much, there was significant changes of larger plants, especially in the top 5 largest plants. Another major change was related to the total volume of the top 30 plants, which grew with 1.7 GW since last year, showing yet another sign of the fast growth of these markets and demonstrating the potential for further growth.

Currently, many other countries in the region are even just warming up, such as Mexico with a pipeline of more than 5 GW set to be installed by 2022, and Argentina with almost 1.7 GW in the pipeline planned for the coming years. With the big pipeline of projects in various stages of development across Latin America and the Caribbean, it can be expected that in another year’s time, the solar PV landscape might have once again changed significantly, when all of the utility-scale solar plants currently under construction start coming online.