We thought it would be interesting to find out what the largest PV plants are that are actually already operating. For this reason, as part of our preparation for the conference Solar Asset Management (June 24-25, Tokyo), we have created an overview of the 25 largest operational PV projects in Japan.

Top 10 Operational Solar PV Plants in Japan

| # | Name | Size (MWp) | Location | Year |

|---|---|---|---|---|

| 1 | Oita Solar Power | 82.02 | Oita City | 2014 |

| 2 | Kagoshima Nanatsujima Mega Solar Power Plant | 70 | Kagoshima City | 2013 |

| 3 | Tahara Solar-Wind™ Joint Project | 50 | Tahara City | 2014 |

| 4 | Kisozaki reclaimed land mega-solar | 49 | Kisosaki Town in Kuwana District, Kuwana City and Yatomi City | 2014 |

| 5 | Softbank Tottori-Yonago Solar Park | 42.9 | Yonago City | 2014 |

| 6 | Tahara Solar Daini Power Plant | 40.7 | Tahara City | 2015 |

| 7 | Futtsu Solar | 40.36 | Futtsu City | 2014 |

| 8 | Tahara Solar Daiichi Power Plant | 40.2 | Tahara City | 2015 |

| 9 | Mito Newtown Mega Solar Park | 39.21 | Mito City | 2015 |

| 10 | Awaji Kifune Solar Power Plant (淡路貴船太陽光発電所) | 34.7 | Awaji City | 2014 |

Some interesting observations from this overview:

Highly fragmented ownership

Only two plants in this overview belong to the same owner (Tahara Solar Co., Ltd.), all the other 23 plants are owned by different companies. This situation matches the situation in Europe a few years ago, before the start of the still ongoing process of portfolios aggregation. We believe the right ingredients are available in the market for this process to take off soon also in Japan.

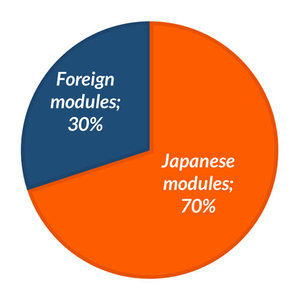

70% of plants in overview contains Japanese modules

Despite the fact we see project developers in Japan increasingly also select non-Japanese PV modules for their projects, of the 25 largest operational projects at least 70% of the plants still contains Japanese modules (of 2 plants this information in undisclosed).

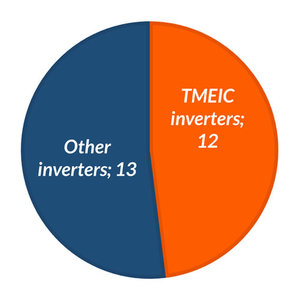

TMEIC is very well represented

It’s impressive to see how Japanese inverter TMEIC has a large share in these largest PV plants: nearly half of these plants (12) rely on inverters from this Japanese market leader. It will be interesting to see if this picture is the same for utility scale PV plants still to be constructed.

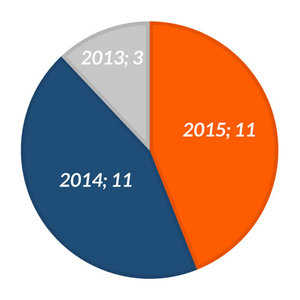

Plants still very young

Of this overview, only 3 plants have been connected in 2013, 11 of them in 2014, the remaining 11 plants have become operational only in the last 4 months. This points out once again that the Japanese market is still only in the takeoff phase and many issues that will occur during the operational phase are still to be found out – at least for utility scale plants.

Most of the largest plants are in Kyushu area

18 out of the 25 plants in this overview are located in the Western part of Japan and 10 out of the 25 plants are in the Kyushu area. Interestingly, this is very probably in relation to the fact Kyushu Electric (the utility serving this area) has been the first utility to suspend grid access for new plants last September.

Reasons for his large share of big operating plants to be located in this area include the relatively high solar irradiation and relatively slightly lower prices of land.

We leave it to the readers to draw further observations and conclusions, feel free to comment on this article and share it. Stay in the loop for further Top-X articles we are working on (projects under construction, PV portfolios) or let us know any suggestions for such overviews.

What makes the conference Solar Asset Management Asia ( June 24-25 in Tokyo) unique, is its strong focus on all topics relevant to the operational phase of PV plants and portfolios. Please visit www.solarassetmanagement.asia for more information.

The overview is based on public available data and might not be totally complete. Please feel free to contact us directly with any comments, suggestions or corrections.