On May 12, 2017, Solarplaza organized the webinar “Overview of Asian solar PV market and financing opportunities”. Benjamin Attia, analyst at GTM Research, and Rohan Singh, Managing Partner for Asia at Finergreen joined the webinar as speakers and provided a bird's eye view on solar market developments in the Asian region and the financing opportunities available there. The entire video recording of the webinar and the speakers’ slides can be freely accessed here.

-

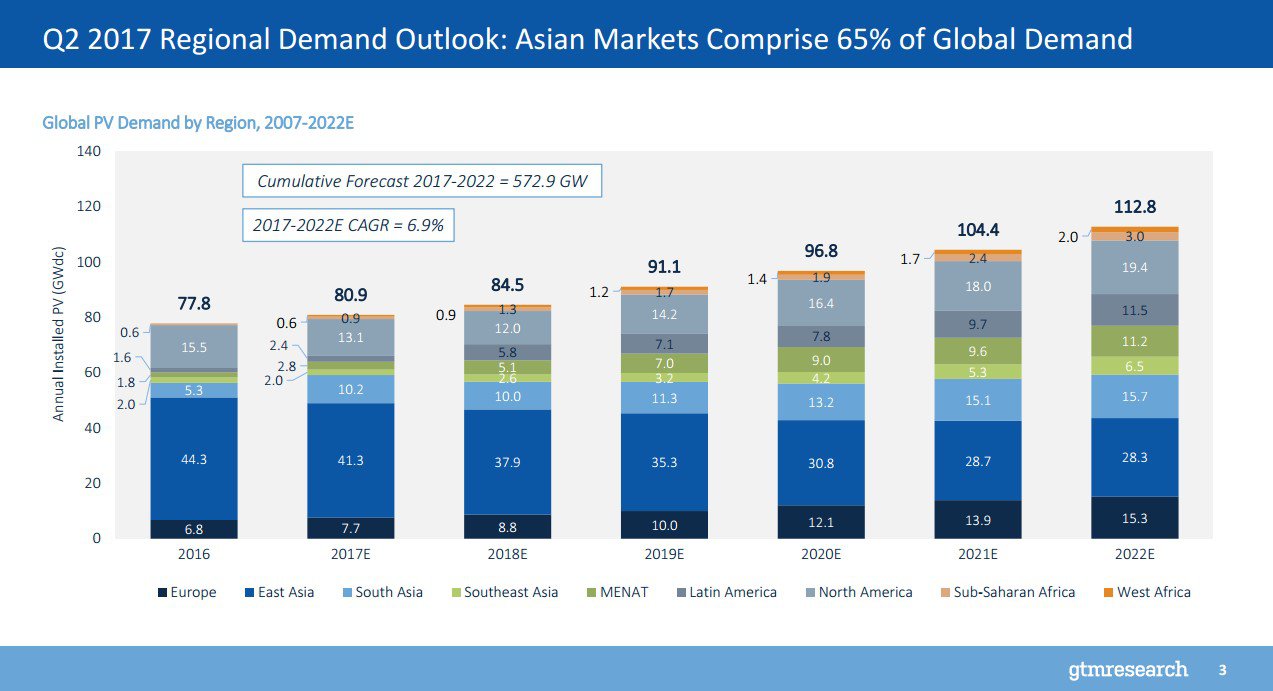

Asia remains at the forefront of the solar revolution, despite FiT cuts and low fossil fuel prices, and will comprise 65% of global PV demand in 2017;

-

Solar demand in China and Japan will likely decrease over the next five years as they transition away from FiT schemes;

-

Securing financing is the name of the game for developing solar in Asia, and that means ensuring bankability.

The Road Ahead for Asian Solar

The world’s demand for solar energy seems insatiable. Even as fossil fuel prices remain the lowest in decades and feed-in tariffs receive cut after cut, there is no end in sight for the solar revolution; in fact, it is happening faster than ever. Governments across the world are rapidly adopting favorable legal frameworks for the development of solar energy: 48 national markets have already instituted a reverse auction or tender procurement programs, up from 32 at the beginning of 2016. An additional 25 markets are on their way to doing the same this year.

Latest estimates from GTM Research predict that 80.1 GW of additional solar capacity will be installed over the course of 2017. Two thirds of this capacity will be installed in Asia, which should leave no doubt as to why investors across the world have set their eyes on the Asian solar PV market. Of course, this market is dominated by China and Japan, which make up the vast majority of solar demand.

Slide presented by Greentech Media during the webinar. Access the recordings for all slides

China specifically greatly exceeded expectation in 2016, installing over twice as much solar capacity (34.23 GW) compared to 2015. Despite its phenomenal performance, Chinese demand will likely decrease gradually over the course of the next five years. According to GTM Research, on average Chinese demand for solar energy will decline by 7.3% per year during this period. Nevertheless, the global outlook for solar remains positive, with an expected 5.3% growth in solar installations over the course of 2017.

Unsurprisingly, the main demand driver for Chinese solar development during 2016 was the normal quota of the government’s Five-Year Plan, which accounted for 72% of installed capacity. Since feed-in tariffs are expected to be cut by 13-19% (depending on province) and the presence of policy risk, distributed generation is projected to more than double in 2017, from 4 GW to 9.8 GW. Market segmentation towards smaller-scale installations seems inevitable.

The National Energy Administration (NEA) maintains an opaque policy environment, and this leaves just two likely scenarios for Chinese demand in the future. Either FiTs remain and are gradually cut in order to be replaced with competitive procurement, or the whole FiT scheme is dropped entirely during the next FiT cut cycle.

The situation in Japan largely mirrors that of China, with demand for solar estimated to go down over the next five years. With FiTs being phased out and over half of the 50+ GW FiT-approved pipeline now cancelled, demand for Japanese solar development is bound to go down.

Slide presented by Greentech Media during the webinar. Access the recordings for all slides

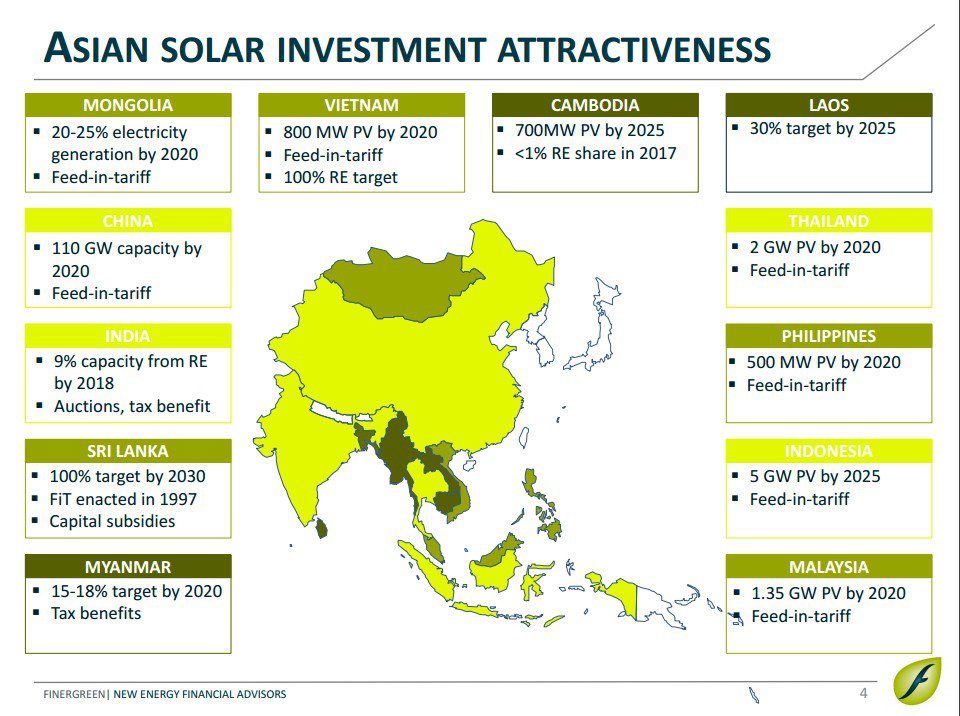

Solar in South Asia is driven by development in India. It is set to become the third largest national market in the world in 2017, thanks to aggressive bid competition that is made possible by the region’s low module prices. Unlike Japan and China, India’s solar development is expected to continue accelerating throughout the next five years, from the current 4.9 GW developed in 2016 to 13.2 GW in 2022. Elsewhere in the region, Pakistan has a 2.4 GW pipeline of utility-scale solar, with tenders from the National Electric Power Regulatory Authority (NEPRA) expected to arrive later this year.

Southeast Asia remains plagued by policy uncertainty, which hampers foreign investment in the region. Nevertheless, forecasts predict a 26% growth rate during 2017. In Thailand, for example, despite only a 40% subscription to the self-consumption program, 4.6 GW of new solar capacity is likely to be installed by 2022, with the agriculture co-op program tender accounting for 500 MW.

Malaysia is poised to exceed its national target of 1 GW thanks to the introduction of net metering and utility-scale FiTs. In the Philippines, the approved project pipeline has already exceeded 4 GW. In Vietnam, over two-thirds of their 5 GW pipeline is from local developers. Overall, although policy risk is a threat to these multi-gigawatt pipelines, it is likely that they will be realized successfully.

Solar Bankability Walkthrough

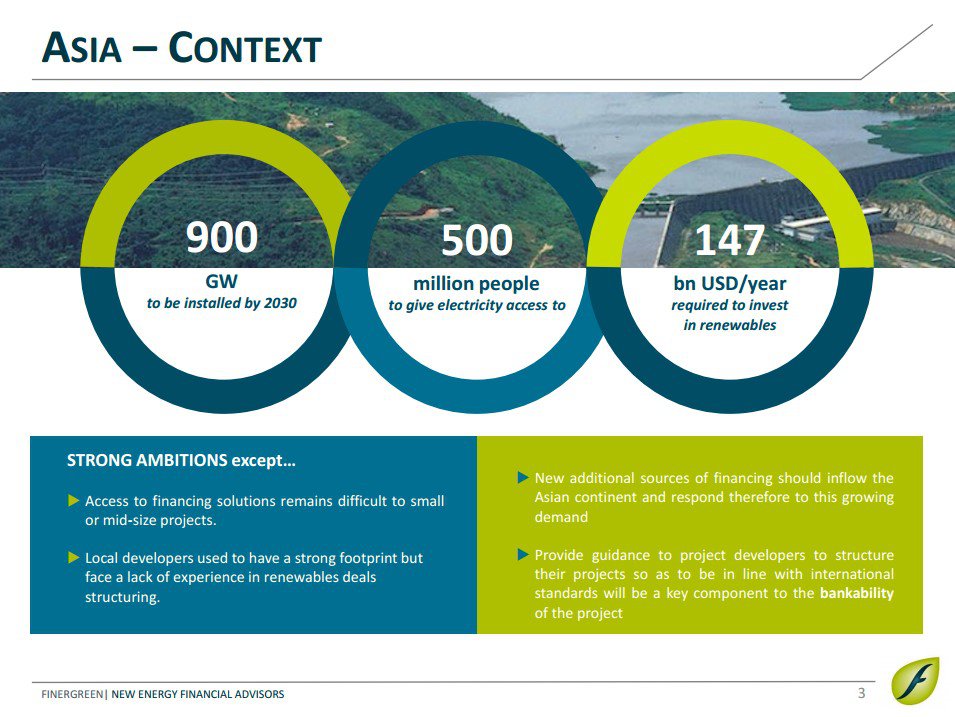

Considering Asia’s vast demand for solar energy, it is only natural for it to encounter financing problems along the way. The question of bankability is on the minds of all solar stakeholders, but it is especially important for the lender. A solar project is only considered bankable if lenders are willing to finance it while taking into account a variety of factors.

Among the key criteria for solar bankability are stability and predictability of cash flows, whether the debt service coverage ratio and the debt service reserve account are satisfactory, the track records of all involved stakeholders (module producers, project developers, service providers, investors), and the integrity of guarantees.

Slide presented by Finergreen during the webinar. Access the recordings for all slides

The road to solar bankability is a long and windy one, but to a shrewd lender it will sound familiar. On the development side, one must identify the government’s electricity needs and targets. Limiting environmental impact is important, and necessitates taking extensive environmental risk mitigation measures and conducting extensive environmental impact studies.

In order to avoid technical difficulties and a surge in costs, EPCs must be rigorously selected and quality feasibility studies must be conducted and peer reviewed. A project’s development must minimize potential social unrest, which necessitates using sparsely-populated areas for utility-scale projects.

To ensure the availability and performance of the asset, equipment quality must be ensured. In general, O&M expenses in the solar sector are low, but nevertheless the O&M agreement should include proper incentives.

In order to limit the risks of political influence, corruption and civil war, one must be extremely careful in selecting independent project participants. Obtaining financing from publicly listed companies and international institutions is vital. In extreme cases, applying for a MIGA guarantee may be necessary.

Slide presented by Finergreen during the webinar. Access the recordings for all slides

Of course, when dealing with foreign markets currency risk becomes a primary determinant of a project’s success. This is especially valid for operating in developing markets which are prone to currency volatility. Ideally, PPAs should be denominated in USD; when that isn’t possible, setting up currency swaps on cash flows is a great alternative.

In terms of actual funding solutions, the Asian region offers diverse ways of bridging the gap in capital requirements. A big factor in obtaining financing in Muslim-majority countries like Pakistan and Malaysia is the use of Islamic financing. Since Islamic law views money as a measuring tool rather than an asset, the act of charging interest (usury) is prohibited.

Sharia-compliant financing is encouraged, for example, by the Malaysian government. In Pakistan earlier this year a record-breaking $955 million of Sharia-compliant debt was issued to finance what will eventually become the country’s 4th largest hydropower plant.

New financing institutions are constantly emerging in Asia, like the Asian Infrastructure Investment Bank, which began operations in january 2016, and the New Development Bank, which issued its first ‘green’ bonds in Q3 2016.

Of course, despite the recent progress financing still remains one of the chief challenges for solar development. For all of Asia’s immense renewable potential, it’s important to maintain the momentum that has been built up over the past five years. It is up to the leading countries like China, India and Japan to remain exemplary in order to pave the way for the new entrants in the Asian renewables scene.