On the 10th of October 2017, Solarplaza hosted a webinar on solar development in emerging markets: The Evolving Landscape of Solar PV in Emerging Markets. It was organized in the run-up to the 2-day Making Solar Bankable conference in Amsterdam, the Netherlands on the 15th and 16th of February 2018. Borja Gutierrez, Sr. project manager at Solarplaza, was joined by Jeremy Leggett, founder of Solarcentury, and Manuel Cabrerizo, managing director at Voltiq, to give an in-depth look at past experiences in developing markets and discuss the future of solar pv development in emerging markets. The entire video recording of the webinar and the speakers’ slides can be freely accessed here.

Jeremy Leggett, founder of Solarcentury and board member of SolarAid with years of experience in the solar PV industry, believes that if the current energy developments keep progressing, the average price of solar energy sold at auctions in 2020 could drop to a price lower than half of the average price of coal in 2016. Research by Bloomberg supports this claim, and projects that the technology has the potential to be cheaper than coal by 2025.

Emerging market landscape

Recently, there was a spectacular record breaking solar energy auction bid in Saudi Arabia of $17,90 per MWh, equivalent to $0,0179 per kWh. This auction bid has raised many questions about solar development in emerging countries. The main questions relate to the actual feasibility of building solar plants at these prices and the profitability of such projects. It is also worth looking beyond the pricing and actually investigate the motivations behind this record breaking bid.

The record bid was from a company from Abu Dhabi, Masdar. The country has expressed much interest in renewable energy during the past few years. Even the crown prince has declared that, in 50 years, when oil runs out, the nation will be celebrating its change of direction with regards to clean energy investments.

When it comes to high investments in clean energy sources, Abu Dhabi is not the only city with promising targets. Dubai wants to have solar panels on every roof by 2030 and wants to source 75% of the total energy produced in the city from clean sources. The goal for Dubai is to become the city with the smallest carbon footprint by 2050. Saudi Arabia has also expressed interest in clean energy. To such an extent that the crown prince regards oil to be almost more of a problem than an asset.

In 2016, solar was - for the first time - the single biggest sector for new global power capacity additions. The graph above shows how the top players in the solar PV industry have been performing throughout the years. China has by far the most amount of total global installed solar capacity, followed by Japan, and trailed by Germany, USA and Italy. Notably, the amount of capacity of the rest of the world has been growing constantly and is also predicted to keep up this trend for the coming years.

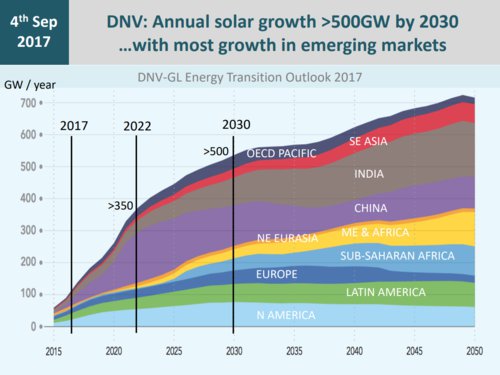

The forecasts for the annual solar growth from 2017 to 2030 indicates that in 2020 the global market is projected to grow with more than 350 GW and that in 2030 the annual growth is foreseen to exceed 500 GW. Most of the growth after 2030 is projected to come from emerging markets, with significant growth spread out through India, China, South-East Asia, Africa and Latin-America. The estimations project the growth to represent more than a trillion dollar worth of investments between 2017 and 2030.

Macro developments

In the past few years, there have been some favourable marco developments in emerging markets around the globe. Large scale asset purchasing has led to a very aggressive market, significantly more aggressive than two years ago. According to Manuel Cabrerizo, managing director of Voltiq, the market is experiencing a high degree of competition among equity players for assets and profitable projects.

Another factor that has had a massive influence on the market is de-carbonization. This has led equity investors and debt providers to focus more and more on renewables, as well as dramatically increasing their their financial allocations in the renewable energy sector.

The rising demand for renewable energy projects has also had a strong effect on the development of the global market. The demand has grown to such a degree that it surpassed what the international market has to offer. From the point of view of the equity suppliers and large institutional investors, there is a scarcity of profitable projects. Remarkably, international players have responded to emerging markets experiencing political improvements and are able to attract enthusiastic investors, for example, the situation in Argentina, Colombia or Myanmar.

The increasing competition in the renewables energy sector has led towards downward pressure to be put on returns. Both equity and debt investors are preparing themselves to take larger risks in order to keep the same level of returns. Auctions have also affected the market by pushing tariffs down, while at the same time reducing leverage and the amount of returns.

When it comes to funding, project financing is still a financial tool that has remained mainstream in the industry with development and financing institutions (DFIs) dominating several markets, such as Egypt and Jordan. Manuel believes that project bonds have been increasing in popularity as a reality for investment-grade projects, even in non-investment-grade countries. He also sees insurance providers slowly increasing their activities when it comes to bond coverage in emerging countries to allow ratings to reach the threshold required by international investors. All of these factors and trends have contributed to making equity deals more common in emerging markets, leading to extremely positive future outlooks for these markets, particularly in solar PV.